Who Holds 90% Of The Wealth? Unpacking Global Financial Realities

Have you ever stopped to wonder about the vast sums of money and assets in the world, and just who, exactly, has possession of most of it? It's a question that, you know, often sparks quite a bit of discussion and curiosity. When we talk about "holding" wealth, we're really talking about having ownership or control over financial resources and valuable possessions. This includes things like money in the bank, investments, real estate, and other significant assets. It's about who has these things at their disposal, ready to use or invest as they see fit.

This idea of who "holds" the wealth is a pretty important one, actually, especially when we look at the global economy. It touches on how resources are shared, how opportunities are created, and even how societies function. The distribution of wealth isn't just about numbers; it's about the lives and experiences of billions of people across the planet, too.

So, we're going to explore this intriguing question: "Who holds 90% of the wealth?" We'll look at what that really means, who these individuals or groups might be, and what factors contribute to such a significant concentration of financial power. It's a topic that, you know, is very relevant in our world today, and understanding it can help us make sense of many global trends.

Table of Contents

- Understanding Wealth and Its Possession

- The Global Picture: Who Are the Wealth Holders?

- How Wealth Becomes Concentrated

- The Impacts of Wealth Concentration

- Addressing the Imbalance: Possible Paths Forward

- Frequently Asked Questions About Wealth Distribution

Understanding Wealth and Its Possession

Before we can truly get into who holds the lion's share of the world's wealth, it's pretty important to, you know, clearly define what we mean by "wealth" itself. Wealth isn't just about the cash someone has in their wallet or their checking account. It's a much broader concept that encompasses all the assets a person or entity owns, minus any debts they might have. So, in a way, it's a measure of their net worth, which is something very significant.

When we talk about someone "holding" wealth, as my text points out, it means they "have possession or ownership of or have at one's disposal." This definition is, you know, really key here. It means having control over resources that can be used, sold, or invested. Think about it: if a bank "holds large reserves of gold," as my text mentions, that gold is an asset that contributes to its overall financial strength and ability to conduct business. Similarly, an individual who "currently holds the position of technical manager" might not be directly holding wealth in their hands, but their position gives them a certain level of financial stability and access to resources that builds their personal wealth over time, you know.

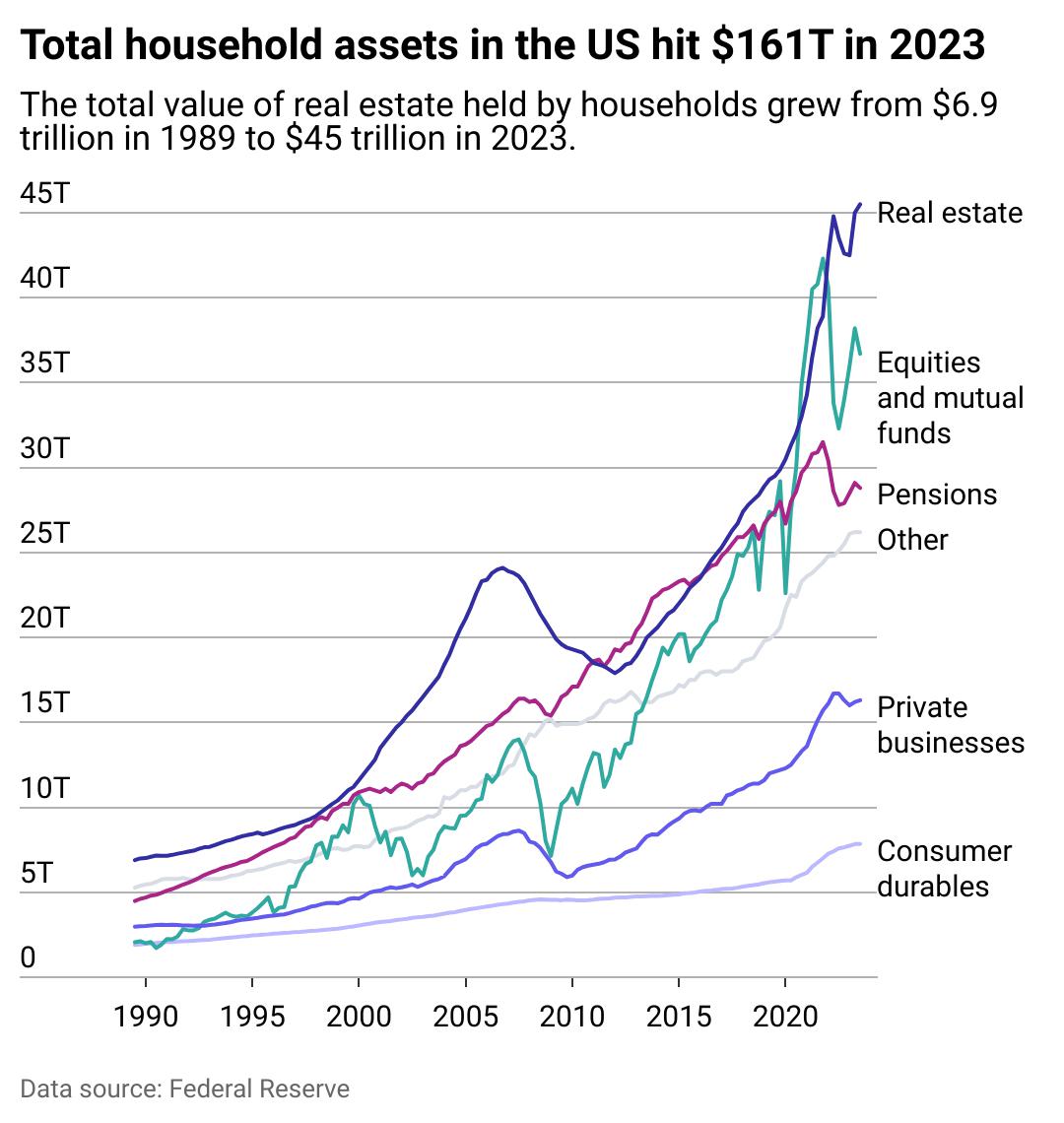

The forms of wealth are, too, quite varied. They include financial assets like stocks, bonds, mutual funds, and savings accounts. Then there are tangible assets, which are things you can touch and see, like real estate—houses, land, commercial properties—and even valuable personal items such as art collections, jewelry, or rare cars. For businesses, wealth can also be in the form of machinery, intellectual property, or even the value of their brand. It's a really broad category, you know, that covers a lot of different things.

Understanding this broad scope is, therefore, pretty crucial. When statistics tell us that a small group "holds" a large percentage of global wealth, they are counting all these different types of assets. It's not just about who has the most cash; it's about who has the most control over the world's productive and valuable resources. This distinction, you know, is quite important for grasping the full picture of wealth concentration around the globe.

The Global Picture: Who Are the Wealth Holders?

So, the big question is, who exactly "holds 90% of the wealth?" While the exact percentage can, you know, fluctuate slightly depending on the source and the year of the data, the general consensus among economists and financial institutions is that a very small fraction of the global population possesses an overwhelmingly large portion of the world's total wealth. This isn't just a slight imbalance; it's a really significant concentration of resources, you know, in very few hands.

The Top 1 Percent: A Closer Look

When people talk about extreme wealth concentration, they are, you know, almost always referring to the "top 1 percent." This group represents the wealthiest individuals on the planet. Their collective assets, including everything from vast stock portfolios to sprawling real estate empires and private businesses, far exceed the combined wealth of the vast majority of the world's population. It's a statistic that, you know, can be quite startling for many people.

These individuals are not, you know, just very successful professionals or even high-income earners in the traditional sense. While some may have built their fortunes through entrepreneurship or innovation, many others have inherited significant assets or have seen their wealth grow exponentially through strategic investments in global markets. The sheer scale of their holdings means that even small percentage gains on their assets translate into enormous increases in their net worth, which is, you know, quite a powerful effect.

It's important to remember that the "top 1 percent" isn't a fixed group, either. While some names might consistently appear on lists of the wealthiest people, there's also some movement within this group, with new fortunes being made and, occasionally, older ones declining. However, the overall structure of wealth concentration, where a tiny sliver of the population holds a disproportionate amount, remains remarkably consistent over time, you know, across various economic cycles.

This concentration of wealth in the hands of the very few means that a relatively small number of people have enormous financial power. They can, you know, influence markets, shape industries, and even impact political decisions through their investments and philanthropic efforts. It's a dynamic that, frankly, raises many questions about fairness and opportunity for everyone else.

Beyond Individuals: Other Powerful Entities

While individuals often come to mind when we think about wealth, it's also worth considering that other entities "hold" substantial wealth, too. Large corporations, for example, especially multinational ones, possess immense assets and control significant financial flows. They own factories, technologies, vast amounts of intellectual property, and hold large cash reserves, which is, you know, a very important part of the global financial landscape.

Similarly, sovereign wealth funds, which are state-owned investment funds, control trillions of dollars in assets. These funds are typically created by governments to manage surplus revenues, often from natural resources like oil, and they invest globally across various asset classes. These funds, you know, hold a lot of financial clout and can influence markets in significant ways.

Then there are also, you know, major financial institutions like banks and investment firms. As my text noted, "The bank holds large reserves of gold," but they also hold vast amounts of other financial instruments, loans, and client assets. Their ability to move capital and facilitate transactions means they, too, are major holders of financial power, even if they don't "own" the wealth in the same way an individual does. It's a complex web of ownership and control, you know, that really defines the global financial system.

So, while the "90% of wealth" figure often points to individual billionaires, it's part of a broader picture where powerful institutions and even nations, you know, also play a huge role in the global distribution of financial resources. It's a system where many different players have a hand in holding and directing wealth.

How Wealth Becomes Concentrated

Understanding *who* holds the wealth is just one part of the story; it's also really important to understand *how* that wealth becomes so concentrated in the first place. This isn't, you know, just a random occurrence; it's the result of a combination of economic structures, policies, market dynamics, and historical factors that have, you know, tended to favor the accumulation of assets by a select few.

Economic Systems and Policies

The prevailing economic systems in most parts of the world, which are, you know, largely market-based, inherently allow for wealth accumulation. These systems, with their emphasis on private property, competition, and capital growth, create environments where some individuals and entities can acquire and expand their assets more effectively than others. This isn't to say these systems are bad, but they do, you know, have certain tendencies.

Government policies also play a significant role. Tax policies, for example, can either exacerbate or mitigate wealth inequality. Lower taxes on capital gains or inheritances, for instance, can allow existing wealth to grow faster for those who already have it, whereas higher progressive taxes might help redistribute some of that wealth. Regulations on industries, labor laws, and even access to education and healthcare can all, you know, indirectly affect how wealth is distributed across a population.

Consider the idea of "holding" a position, as my text puts it: "He currently holds the position of technical manager." The opportunities available in certain sectors or the ability to secure high-paying roles are often tied to broader economic policies that shape the job market and access to skills. Policies that support innovation and new industries can create new wealth, but how that wealth is shared depends, you know, very much on the rules of the game.

Furthermore, global trade agreements and international financial regulations can also influence wealth concentration. These frameworks can, you know, create advantages for certain countries or corporations, allowing them to expand their operations and accumulate wealth on a global scale. It's a very interconnected system, really.

Financial Markets and Investments

Financial markets are, you know, a primary engine for wealth growth and concentration. Those who already have substantial capital can invest in stocks, bonds, real estate, and other assets that tend to appreciate over time. The concept of "compounding returns" means that money invested earns returns, and those returns then earn their own returns, leading to exponential growth over decades. This process, you know, is particularly beneficial for those starting with a large base.

Access to these markets is also a key factor. While theoretically open to everyone, the knowledge, resources, and risk tolerance required to make significant, successful investments are often more readily available to those who are already wealthy. They can afford expert financial advice, diversify their portfolios more effectively, and withstand market downturns that might devastate smaller investors. This means, you know, the rich often get richer at a faster rate.

Moreover, the rise of globalized financial markets means that wealth can be moved and invested across borders with relative ease. This allows the wealthy to seek out the most profitable opportunities worldwide, further accelerating their accumulation of assets. It's a system that, you know, tends to reward those who can play on a global stage.

Even things like the ability to "hold" an object securely, as my text describes "to have or keep (an object) with or within the hands," applies to financial assets. Those with wealth can hold onto their investments through market volatility, knowing that historically, assets tend to recover and grow over the long term. This patience and capacity to absorb short-term losses is, you know, a luxury not afforded to everyone.

Inheritance and Generational Wealth

A very significant factor in wealth concentration is the transfer of wealth across generations. Large inheritances mean that significant assets are passed down, allowing subsequent generations to start with a substantial financial advantage. This can create a cycle where wealth continues to accumulate within the same families, regardless of their individual efforts or contributions to the economy. It's a phenomenon that, you know, really shapes the landscape of wealth distribution.

This generational transfer isn't just about money; it's also about opportunities. Children from wealthy families often have access to better education, networks, and opportunities to build their own careers or businesses, which can further enhance their inherited wealth. They might have access to capital to start ventures, or connections that open doors, which is, you know, a considerable head start.

The absence of robust inheritance taxes in many regions means that these vast sums of wealth can pass largely untaxed from one generation to the next. This allows wealth to persist and grow within a few families, creating what some call "dynastic wealth." It means that, you know, the past continues to shape the present financial landscape in a very powerful way.

So, in essence, the ability to "hold" wealth for generations, as my text might imply by "This system still holds good," means that the advantages of wealth can be perpetuated over long periods. This mechanism, you know, is a really powerful driver of ongoing wealth concentration, making it harder for those starting with less to catch up.

The Impacts of Wealth Concentration

The fact that a small group "holds 90% of the wealth" isn't just an interesting statistic; it has, you know, very real and far-reaching consequences for societies and economies around the world. These impacts touch on everything from economic stability to social cohesion and even political systems. It's a situation that, you know, creates a lot of ripple effects.

Economic Implications

One of the key economic implications of high wealth concentration is its potential effect on economic growth. Some argue that when wealth is concentrated at the very top, there might be less overall demand in the economy because the wealthy tend to save and invest a larger proportion of their income compared to those with lower incomes, who spend a greater share on goods and services. This can, you know, potentially slow down economic activity.

Furthermore, concentrated wealth can lead to a misallocation of resources. Investments might flow into sectors that benefit the wealthy, such as luxury goods or speculative financial assets, rather than into areas that could generate broader economic benefits, like infrastructure, education, or small businesses. This can, you know, create imbalances in the economy.

It can also lead to increased financial instability. When a large portion of wealth is tied up in a few hands, the decisions and actions of those individuals or a small number of institutions can have an outsized impact on financial markets and the broader economy. This creates a system that, you know, might be more vulnerable to shocks or crises, as the collective actions of a few can have very wide-ranging consequences.

The ability of the wealthy to "hold" significant financial power means they can, you know, influence the direction of entire industries. As my text says, "If people such as an army or a violent crowd hold a place, they control it by using," similarly, financial power allows control over economic sectors. This control can shape job creation, innovation, and economic opportunities for many others, for better or worse, you know.

Social and Political Effects

Beyond economics, significant wealth concentration can have profound social impacts. It can lead to increased social inequality, where disparities in income and opportunity become more pronounced. This can, you know, create feelings of unfairness and resentment among those who feel left behind, potentially leading to social unrest or division. "Nobody is going to hold it against you if you don't come," as my text says, but people might hold it against a system that seems inherently unfair.

Access to essential services like quality healthcare, education, and housing can become stratified, with the wealthy having access to superior options, while others struggle. This creates a two-tiered society where opportunities are not equally distributed, which is, you know, a serious concern for many.

Politically, concentrated wealth can translate into concentrated political power. Wealthy individuals and corporations can, you know, influence policy-making through lobbying, campaign contributions, and media ownership. This can lead to policies that further benefit the wealthy, creating a feedback loop where economic power reinforces political power, and vice versa. It's a dynamic that, you know, can undermine democratic processes and public trust.

The idea that "This system still holds good" might be true for those at the top, but for many others, it might feel like a system that doesn't serve their interests. The sheer scale of wealth held by a few can, you know, make it seem as though their concerns are prioritized over the needs of the broader population, leading to a sense of disenfranchisement and a decline in social cohesion.

Addressing the Imbalance: Possible Paths Forward

Given the significant implications of wealth concentration, many discussions revolve around how societies might, you know, address this imbalance. There isn't one single solution, but rather a range of approaches that policymakers, economists, and citizens consider. These ideas aim to either redistribute existing wealth or create more equitable opportunities for wealth creation in the future, too.

One approach involves changes to tax policies. This could mean implementing more progressive income taxes, where higher earners pay a larger percentage of their income, or increasing taxes on capital gains and inheritances. The goal is to, you know, generate revenue that can then be used to fund public services or social programs that benefit a wider segment of the population, thereby reducing disparities. It's a way to try and balance the scales, you know, a bit more.

Another area of focus is strengthening social safety nets and public services. Investing in universal healthcare, quality education from early childhood through higher learning, and affordable housing can, you know, provide a foundation for everyone to build their lives and pursue opportunities, regardless of their starting point. This helps to reduce the impact of inherited disadvantages and creates a more level playing field, which is, you know, quite important.

Reforming labor laws and promoting fair wages are also often discussed. Ensuring that workers receive a fair share of the profits they help generate can help distribute wealth more broadly. This includes supporting collective bargaining, setting minimum wage standards that reflect the cost of living, and addressing issues like precarious work. It's about ensuring that, you know, the efforts of many are adequately rewarded.

Beyond policy, there's also the role of philanthropy and corporate social responsibility. While not a systemic solution, wealthy individuals and corporations can choose to, you know, reinvest their wealth into communities, support charitable causes, and promote sustainable business practices. This can help mitigate some of the negative impacts of wealth concentration, although it doesn't fundamentally change the underlying distribution. It's a voluntary effort, you know, that can make a difference.

Ultimately, addressing who "holds 90% of the wealth" is a complex, ongoing challenge that requires a multifaceted approach. It involves, you know, continuous dialogue, careful policy choices, and a collective commitment to creating societies where opportunities and prosperity are more broadly shared. It's about ensuring that the system, as my text puts it, "still holds good" for everyone, not just a select few, you know, in the long run.

Frequently Asked Questions About Wealth Distribution

People often have a lot of questions about wealth and how it's shared around the world. Here are some common ones that, you know, often come up in discussions about who holds the most assets.

What percentage of wealth does the top 1% own?

While the exact figures can, you know, vary slightly from year to year and depend on the specific reports, most credible sources indicate that the top 1% of the world's population owns a disproportionately large share of global wealth. Recent estimates from various financial institutions and economic forums often place this figure at around 40-50% or even more of the total global wealth. This means that, you know, a very small group holds a huge amount of the world's assets, which is quite a significant concentration.

How is wealth distributed globally?

Globally, wealth distribution is, you know, highly unequal. A small percentage of the population at the very top holds a substantial portion of the world's total assets, while the vast majority of people, particularly those in lower-income countries, possess very little wealth, or even have negative net worth due to debt. The middle class in many regions also faces challenges in accumulating significant assets. It's a very pyramid-like structure, really, with a broad base and a very narrow top.

Is wealth inequality increasing?

Generally speaking, many recent reports and analyses suggest that wealth inequality has been, you know, increasing in many parts of the world over the past few decades. Factors like globalization, technological advancements, and certain economic policies have contributed to this trend. While there might be periods of slight moderation, the overall trajectory points towards a widening gap between the wealthiest individuals and the rest of the population. This is a trend that, you know, many economists and social scientists are closely watching.

Learn more about on our site, and link to this page for further insights into global economic trends. The discussions around wealth distribution are, you know, continuously evolving, and staying informed is always a good idea.

301 Moved Permanently

301 Moved Permanently

107418935-17164196594ED3-FA-WEALTH-TAX-052224.jpg?v=1716419659&w=1920&h