Unlocking The Mystery: What Does OTP Mean In Text? Your Essential Guide

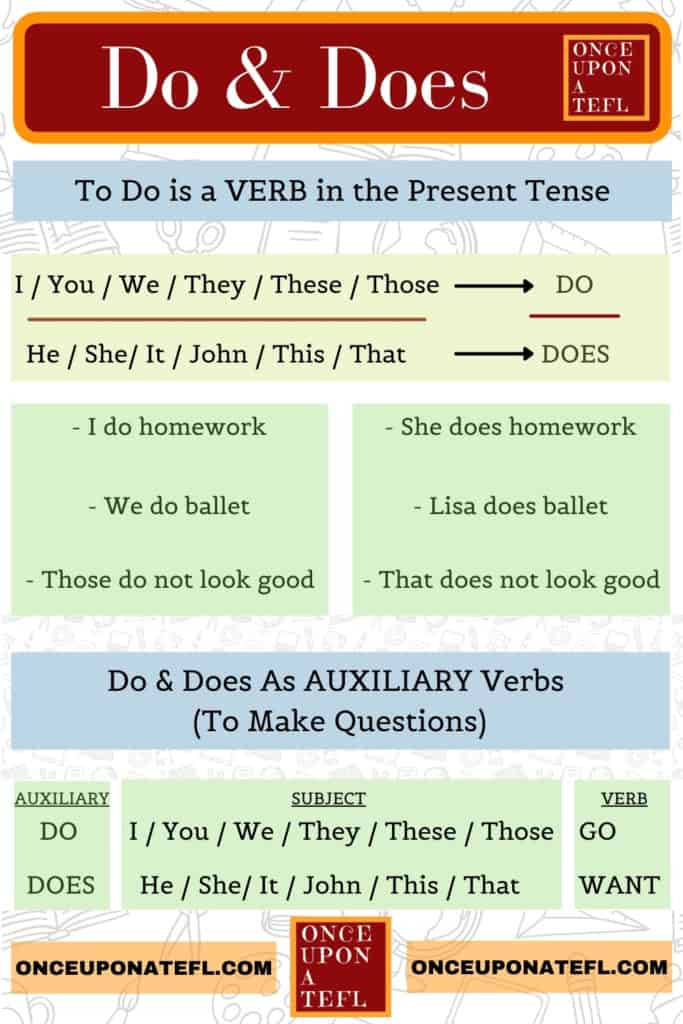

Ever received a text message containing a string of numbers and letters, often labeled "OTP," and found yourself wondering, "What does OTP mean in text?" Or perhaps you've been prompted to enter an OTP during an online transaction or when logging into an account. In our increasingly digital world, understanding this simple acronym is not just about deciphering jargon; it's absolutely crucial for safeguarding your online identity and ensuring the security of your personal information. Just as understanding when to use "do" and "does" is key for speaking and writing English correctly, understanding OTP is key for navigating the digital world securely and confidently.

Many terms in the digital realm can be confusing, but OTP is one you absolutely need to grasp. It's a fundamental part of modern online security, acting as a powerful shield against unauthorized access to your accounts. In this article, we’ll explain exactly what OTP stands for, why it's so important, how it works, and the best practices you should follow to keep your digital life safe. We've put together this guide to help you understand and safely use OTPs as a vital part of your online security.

What Does OTP Stand For? The Core Definition

Let's get straight to the point. The acronym OTP stands for One-Time Password. To define the term, an OTP is a unique, automatically generated sequence of characters—which can be numbers, letters, or a combination of both—that is sent to a user for a single login session or transaction. Unlike your regular password, which you might use repeatedly, an OTP is designed to be used only once, after which it becomes invalid. This 'one-time' nature is precisely what makes it such a powerful security tool.

Think of it as a temporary key that unlocks a specific door for a very brief period. Once you've used that key, it's immediately discarded and can't be used again. This ephemeral quality is central to its security benefits, significantly reducing the risk of unauthorized access even if your main password somehow falls into the wrong hands.

Why Are OTPs So Important? The Security Layer

You might wonder why an extra step is necessary when you already have a password. The answer lies in enhancing security. OTPs are a cornerstone of what's known as Two-Factor Authentication (2FA) or Multi-Factor Authentication (MFA). These security protocols require users to provide two or more verification factors to gain access to an account or complete a transaction.

A Strong Defense Against Cyber Threats

The primary reason OTPs are so important is their ability to add a robust layer of defense against various cyber threats, including:

- Password Theft: Even if a hacker manages to steal your primary password through a data breach or phishing attempt, they still won't be able to access your account without the unique OTP, which is sent to your registered device.

- Phishing Attacks: OTPs act as a crucial safeguard against sophisticated phishing scams. If you mistakenly enter your password on a fake website, the attacker still needs the OTP sent to your device, which they typically won't have access to.

- Unauthorized Access: They prevent unauthorized individuals from logging into your accounts, making financial transactions, or accessing sensitive information, even if they somehow gain knowledge of your static password.

This extra layer significantly reduces the risk of account compromise, making your online activities much safer. It's a simple yet highly effective way to bolster your digital security posture.

Common Scenarios Where You'll Encounter OTPs

OTPs are ubiquitous in the digital landscape. You've likely encountered them in several situations without even realizing their full security implications. Here are some common scenarios:

- Online Banking: When initiating a transfer, adding a new payee, or sometimes even just logging in, your bank will send an OTP to verify it's really you.

- E-commerce Websites: Making a significant purchase, changing account details, or adding a new payment method often triggers an OTP request.

- Social Media & Email: If you're logging in from a new device, resetting your password, or performing sensitive account changes, platforms like Google, Facebook, and Twitter will send an OTP.

- App Registrations & Logins: Many mobile applications use OTPs to verify your phone number during registration or for subsequent logins.

- Password Resets: A common use case is verifying your identity before allowing you to reset a forgotten password.

These examples illustrate how OTPs are integrated into almost every aspect of our digital lives, providing a necessary layer of trust and security.

How Do OTPs Work? A Step-by-Step Process

Understanding the mechanism behind OTPs can further highlight their effectiveness. It’s a straightforward process designed for maximum security and user convenience.

1. The Request

The process begins when you, the user, attempt to perform a sensitive action – such as logging into an account, making a payment, or changing personal details. The system you are interacting with (e.g., your bank's website, an e-commerce platform) recognizes that this action requires an additional layer of verification beyond your static password.

2. The Generation & Delivery

Upon recognizing the need for verification, the system's secure server immediately generates a unique One-Time Password. This OTP is then sent to a pre-registered contact method that only you, the legitimate user, should have access to. Most commonly, this is via an SMS text message to your mobile phone number, but it can also be sent to your registered email address or generated by a dedicated authenticator app. Crucially, these OTPs are time-sensitive and typically expire within a very short window, often 60 to 300 seconds.

3. The Verification

Once you receive the OTP, you must promptly enter it into the designated field on the website or application. The system then verifies the entered OTP against the one it generated. If the OTP is correct and still within its validity period, access is granted, or the transaction proceeds. If it's incorrect or expired, the action is denied, and you might be prompted to request a new OTP.

Types of OTPs: Beyond SMS

While SMS-based OTPs are the most common, there are other methods of delivering these vital codes, each with its own advantages and security considerations:

- SMS-based OTPs: As discussed, these are sent directly to your registered mobile number. They are convenient and widely adopted, but can be vulnerable to SIM swap attacks where criminals transfer your phone number to their SIM card.

- Email-based OTPs: Similar to SMS, these are sent to your registered email address. Their security depends heavily on the security of your email account itself.

- Authenticator App OTPs (TOTP): These are generated by dedicated apps like Google Authenticator, Microsoft Authenticator, or Authy. These apps generate Time-based One-Time Passwords (TOTPs) that refresh every 30-60 seconds. They are generally considered more secure than SMS or email OTPs because they don't rely on network delivery and are less susceptible to phishing or SIM swap attacks.

- Hardware Token OTPs: Less common for general users but prevalent in corporate environments, these are physical devices that generate OTPs. They offer a very high level of security as they are completely independent of your phone or computer.

Best Practices for Handling OTPs: Do's and Don'ts

Understanding what OTP means and how it works is only half the battle. Knowing how to handle them responsibly is equally important. Just like knowing the difference between "do" and "does" ensures correct grammar, knowing these practices ensures correct security behavior.

Do's:

- Always Verify the Sender: Before entering an OTP, quickly check that the sender (e.g., your bank, an online store) is legitimate and that you initiated the action requiring the OTP.

- Enter OTPs Promptly: OTPs are time-sensitive. Enter them quickly before they expire.

- Report Suspicious OTPs: If you receive an OTP for an action you didn't initiate, report it to the respective service provider immediately. This could indicate someone is trying to access your account.

- Understand *Why* You're Receiving an OTP: Before entering any code, ask yourself: "Did I just try to log in? Did I just try to make a purchase?" If the answer is no, be extremely cautious.

- Enable 2FA/MFA: Wherever possible, enable Two-Factor or Multi-Factor Authentication on all your important accounts. OTPs are often a core part of this.

Don'ts:

- Never Share Your OTP with Anyone: This is the golden rule. No legitimate bank, service provider, or government agency will ever ask you for your OTP over the phone, via email, or through text messages. Sharing your OTP would be a really silly thing to do and is almost certainly a scam.

- Don't Enter an OTP If You Didn't Initiate the Action: If you receive an unsolicited OTP, do not enter it anywhere. Someone might be attempting to gain unauthorized access to your account.

- Don't Click on Links in Suspicious Messages Asking for OTPs: Phishing attempts often involve sending fake messages with links that lead to fraudulent websites designed to steal your OTP. Always go directly to the official website.

- Don't Store OTPs: OTPs are meant for one-time use and expire. There's no need to store them.

By adhering to these simple guidelines, you can significantly reduce your vulnerability to online fraud and keep your accounts secure. See examples of OTPs in action by simply observing your next online banking transaction or a password reset process.

Summary

In conclusion, OTP stands for One-Time Password, a critical component of modern online security that provides an essential second layer of defense for your digital accounts and transactions. By understanding what OTPs are, how they function, and the best practices for handling them, you empower yourself to navigate the digital world with greater confidence and safety. Always remember: an OTP is your personal, temporary key; never share it, and always be vigilant about unsolicited requests. Your digital security largely depends on your awareness and responsible use of these powerful tools.

Do vs. Does: How to Use Does vs Do in Sentences - Confused Words

Do Vs Does: How To Use Them Correctly In English

Using Do and Does, Definition and Example Sentences USING DO AND DOES